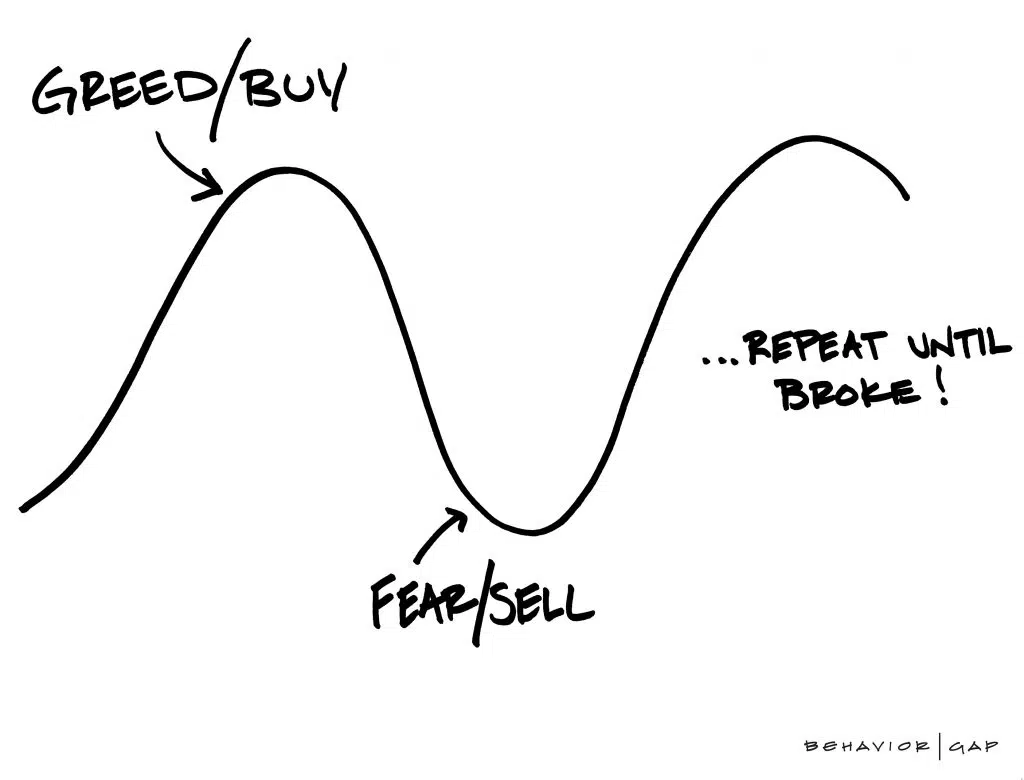

Most investors make the same mistake with their money over and over again. At the top of the market, they can’t buy fast enough. When the market bottoms out, they can’t sell fast enough. They break the number one rule of investing by buying high and selling low. Most people just call this bad investing. But as The Sketch Guy, Carl Richards, illustrates in this sketch, buying high is a form of greed, and selling low is a form of fear. To be clear, the solution here is not to simply throw your hands in the air and give up, since fear and greed are human emotions that you will likely grapple with the rest of your life. The solution is to recognize that, in aggregate, investors tend to be very bad at timing the market. So why even bother? Instead, try this: 1. Ignore what the crowd is doing. 2. Base your investment decisions on what’s needed to reach your goals. 3. Stick with the plan despite the fear or greed you may feel.

Sketch

Fear and Greed