A fantastic, trustworthy, supportive service that has helped me to sort my money goals. I feel a lot safer now when it comes to my money – when it comes to looking after myself and my daughter that is a really important element for me.

New to investing? We’ve been there. Start your investment journey with us.

It’s never too early (or too late!) to build your property or share portfolio, but we know it can be daunting to take those first steps. There’s so much information out there, so it helps to understand what you want to achieve and what it will take to get there.

That’s where we come in. We’re here to help first-time property investors make the most of opportunities in the market, and first-time share investors make sense of all the options.

With our help you’ll have a practical understanding of what it means to be an investor – and the confidence to get started. Knowledge is power!

Let’s do this.

Let’s talk investing.

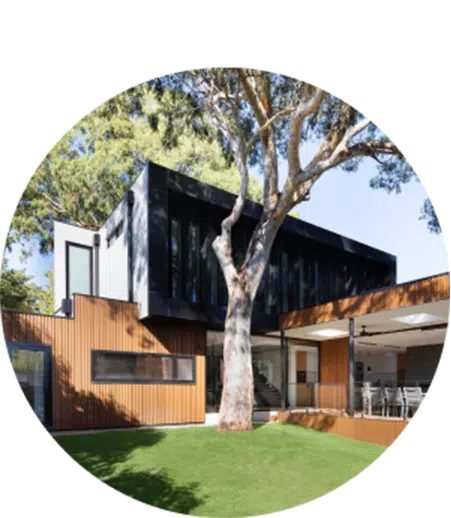

The first step is deciding where you want to invest your money and why. Do you want to buy an investment property or are you leaning more towards the stock market? Everyone has different dreams, so making this decision is an important first step

Jump online and see what’s out there. Look at previous sale prices of properties that you like, in areas that you want to live in – or attend some auctions and experience the excitement of the property market firsthand

If you research has brought up more questions than answers, that’s where we come in. We want to listen to your grand plans and help you make them a reality. Talk to one of our financial advisors and they can tell you what’s possible and make a roadmap toward your bright financial future

We’ll do the heavy lifting & help bring it all to life

(without breaking the bank)

Every financial decision you make could take your life down a different path. So we’ll show you what different options mean, and create your financial roadmap to make sure you don’t get lost along the way

We’ll help you work out how much and where to invest, so you make the most from your tax entitlements while building your portfolio

Your income is one of the most valuable things in your life. Whether you’re on a professional salary, self-employed or juggling multiple gigs, we’ll help you make the most of it

Our income & expenses app MyProsperity makes it super simple to see where your money is going, and make sure you’re on track with your goals

This could be the difference between having a home to call your own, or renting forever. We’ll also help you work through price point, suburb selection and any grants & schemes you’re eligible for

Plans are what make dreams possible. Our mortgage brokers will help you work through how much you can borrow, the deposit you need and which bank is right for your situation

Start with just a few $100 a month in an investment fund and with the right risk and return trade-off, you could be on your way to a $50,000 share portfolio

It’s everyone’s dream come true, an investment tool that straightens out your retirement and saves you tax too. We’ll help you take advantage of it – after all, it’s called super for a good reason

Life is unpredictable, so you need a safety net in the form of savings and insurance. You can always rest easier with a Plan B in place

Yes, we can even help with your loan application – whether it’s your first home or an investment property. Our mortgage brokers will work to find solutions that with your financial plan

See why we’ve been awarded Independent Financial Advisors’ Innovator of the Year.

A fantastic, trustworthy, supportive service that has helped me to sort my money goals. I feel a lot safer now when it comes to my money – when it comes to looking after myself and my daughter that is a really important element for me.

So much clarity. Money mostly seems like a sensitive topic and other companies pushed me back as “too young” to take on as a client. Finnacle changed that. The peace of mind from a plan unique to my lifestyle is honestly a gamechanger.

Working with Dan and Finnacle has been great. It’s nice that they’ve taken time to create that level of trust, which we really wanted when it came to our money. The online platform is easy to use and the flexibiltiy to meet up at any time is invaluable.

This testimonial was given by our customers. They are individual experiences of our customer that has used our service. However, they are individual results and results and outcomes may vary. We do not claim they are typical results that consumers will generally achieve. (Broker name/ business) cannot and does not guarantee results. Your full financial situation would need to be reviewed prior to acceptance of any offer or product.

Kick off your no-obligation trial today – book your 15 minute discovery call

The main benefits of investing in property are the long term returns that a good quality property can bring you, and the ability to increase those returns through gearing (borrowing). Banks prefer lending for property as opposed to many other assets, so you can use a combination of your own savings/equity, a bank loan and rent from tenants to build a property portfolio. There can also be tax benefits provided to property investors, however, this can be changed by the Government and should always be a secondary consideration when deciding to invest.

All investments carry risk. When investing in property these can be reduced by careful research, correct funding and ongoing monitoring, however risks cannot be completely eliminated. The main risks involved in property investing are tenant and vacancy risks (having bad tenants, damage, long periods without tenants), market risks (lower than expected growth and returns), lending/interest rate risks (increasing interest rates meaning the loan repayments are higher) and legislative risks (changes in laws that pass through the Government).

This really depends on your individual situation. Paying off your home loan is a great long term wealth building goal, however the earlier you start investing the more time you have for compounding to work it’s magic! This may be the difference between one investment property and a property portfolio.

This really depends on your individual situation. Paying off your home loan is a great long term wealth building goal, however the earlier you start investing the more time you have for compounding to work it’s magic! This may be the difference between one investment property and a property portfolio.