Get Ready to Level Up Your Finances with the 5-Step Financial Health Check!

Did you know that 90% of Australians have no clue how to measure their financial health? Don’t worry, we’ve got you covered! Based on our research and analysis, we’ve identified 5 key areas that will help you take control of your money and boost your financial status. Check out the key areas to get on top of below, and take our Financial Health Check quiz to see how you are going! You can also check out more about what a Financial Adviser does and how they can help!

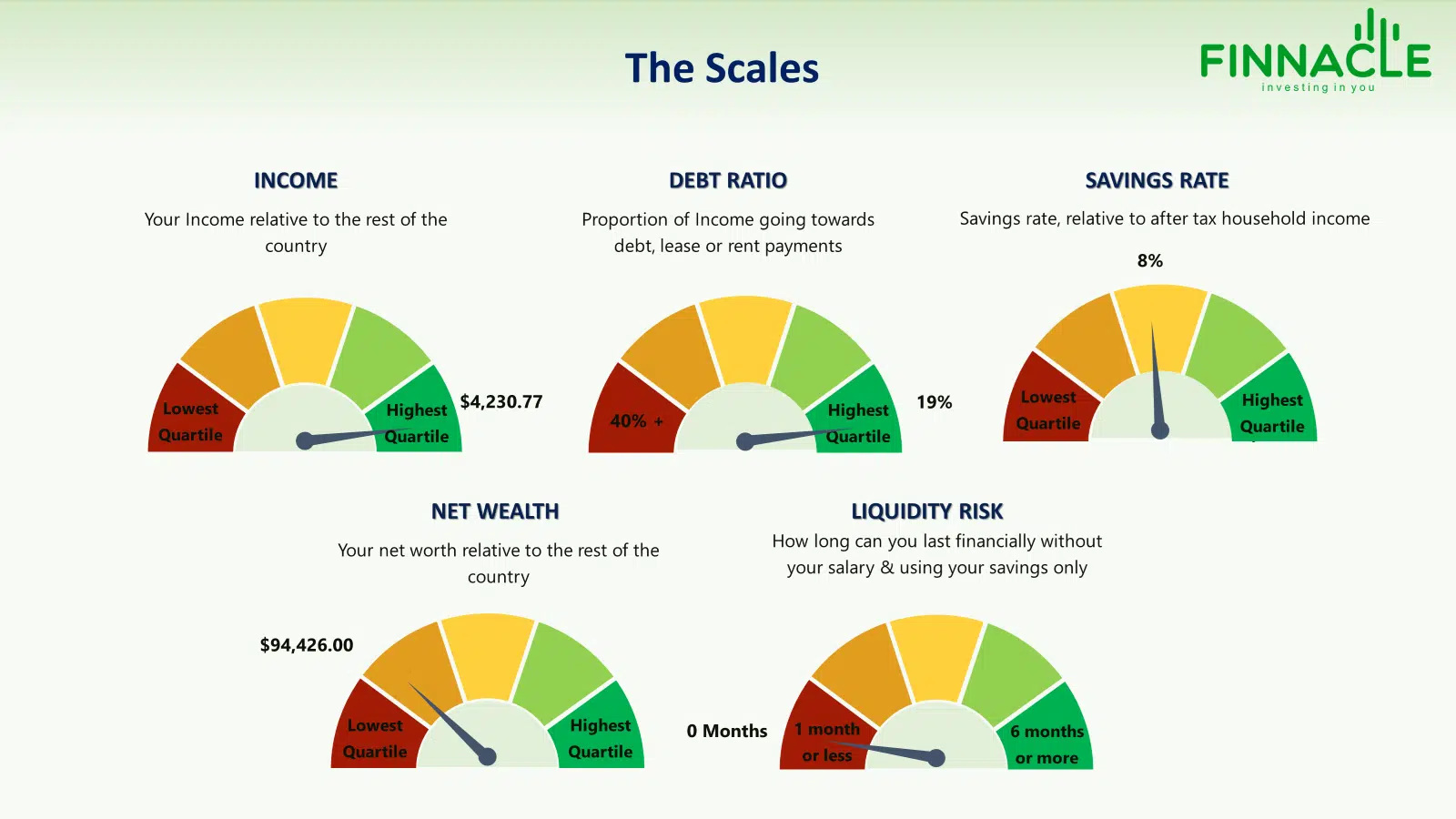

Income

Make sure you’re getting what you’re worth and set yourself up for future success! Your income not only impacts your borrowing capacity but also determines your ability to cover expenses and have some extra cash left over. Income isn’t the most important area on this list, but Australia has a high cost of living so you need to make sure you are earning an income that can cover the necessities and leave some money left for the areas below.

Debt

Understand your debts and their impact. Whether it’s a home loan, car loan, personal loan, or credit card, learn how much of your income goes towards paying off your debts and keep track of your debt repayments as a percentage of your income.

If you have little or no debt currently that is great, however it is good to understand this area for future requirements (such as a home loan). There are two measures to be aware of here:

- How much of your take home pay is going towards paying off your debts (plus the interest that they accrue); and

- The amount of debts you have as a percent of your total assets.

Borrowing will provide you with more money now to purchase what you want, however will leave you with less cash in the future as you pay back the loan. Utilising debt effectively is a major factor in building your wealth, so it is extremely important to understand these key ratios and stay within healthy bounds.

Savings Rate

The first step to financial freedom! Saving money is essential for investing and achieving your dreams. Start small and gradually increase your savings rate to build an emergency fund and secure your future.

We spoke about how your income impacts things above, however if you spend more than you earn you will be broke quickly. Improving your savings rate will help build your emergency buffer, get a deposit for your home and get you on the path to becoming truly wealthy. A good rule of thumb is to aim to save 10% of what you take home each pay (20% is ideal).

An easy way to get there is to start small (even a few percent) and increase this gradually as you get used to living on less. You can also increase this rate when you get pay rises so you don’t actually dip into what you currently earn. For example, if you get a 3% pay rise you can put an extra 2% aside, still have some extra to spend and know that you are boosting your bottom line!

Get your FREE Financial Health Check here!

Prepare for Emergencies

Lay the foundation of financial security by having enough savings to survive without income for a period of time.

Ideally, we want to get to have 6 months of your expenses sitting in savings that can be used for emergencies, however 3 months is a good start. There are also things you can do to reduce the risk of certain things happening – for example healthy people tend to get sick less – and you can take out certain insurances to protect against the things that you can’t control, such as bushfires, floods and cancer.

Any insurances should be looked at as part of an overall plan – what are the high risks, what is the potential impact of these and what is the cost to insure them? Spending 3-5% of your total income to protect yourself, as well as building up your emergency fund, will ensure your financial foundations are in place and you can build your dream life on top.

Net Worth

The ultimate goal – increasing your net worth and achieving financial independence. This is the area that everyone wants to nail – it’s the one that people talk about and gets heads turning.

In reality, this only comes about by doing the other things well. You want to be steadily increasing your net worth – after taking out the debts you owe – as this is what will ultimately provide you with a passive income in the future and allow you to achieve financial independence. The income from your investments will be able to fund your holidays, your business venture, charity work and anything else you want to do in your life.

As you successfully manage the previous steps, you’ll be on your way to generating passive income and living the life you’ve always dreamed of.

There are so many things being written about money and finance these days that it can be hard to know what to focus on without becoming overwhelmed. We have found that the 5 areas of the financial health check is the key to improving your finances, feeling in control of your money and ultimately getting on the path to financial freedom.